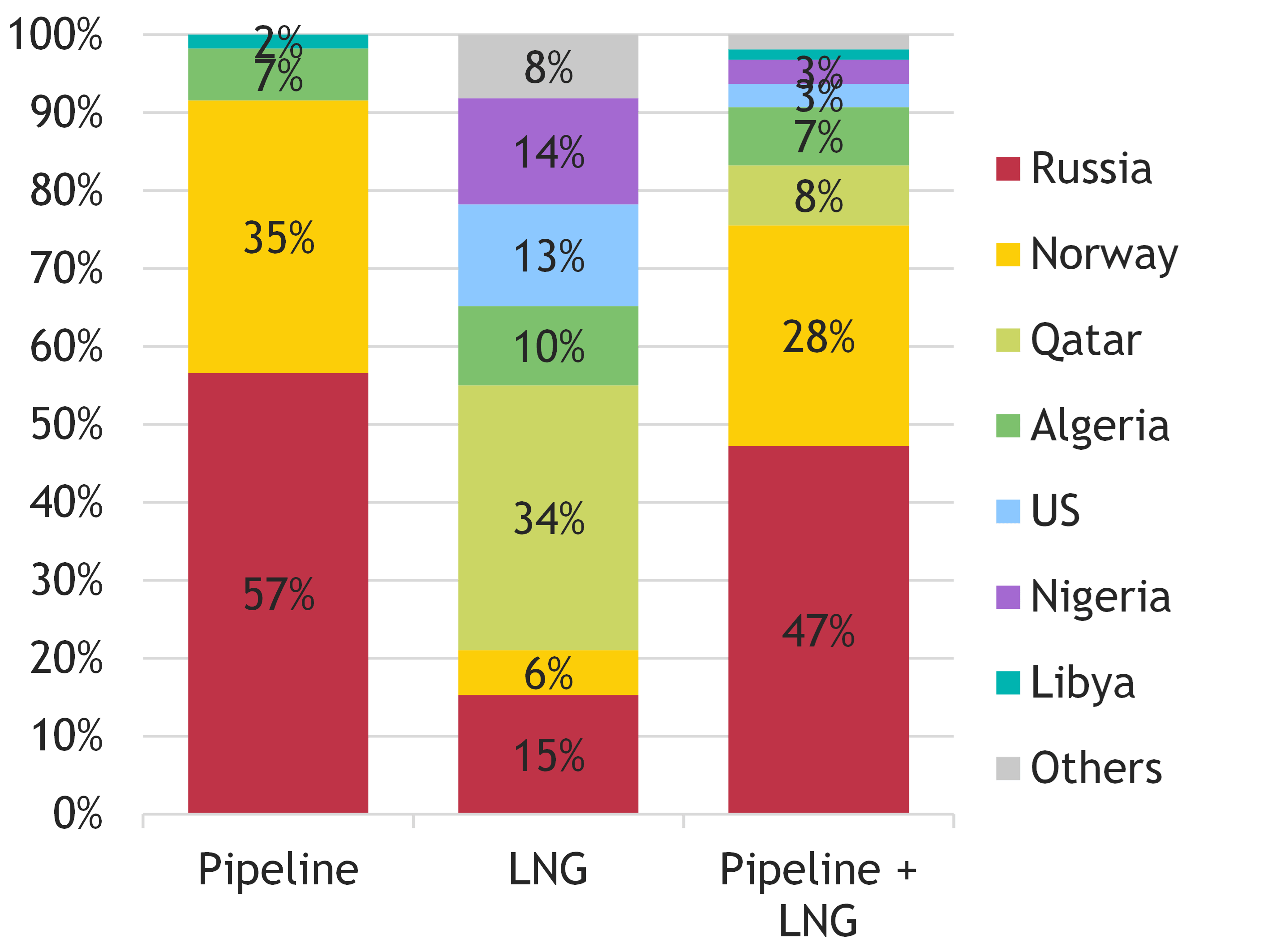

The EU imports large quantities of fossil energy sources such as natural gas, hard coal, crude oil as well as uranium from third countries. In 2019, approximately 47 percent of EU natural gas imports came from Russia, 28 percent from Norway, and 8 percent from Qatar. This is according to the analysis “German and European Energy Imports” by the Energy Economics Institute (EWI) at the University of Cologne.

The analysis provides an overview of where and in what quantities the EU and Germany have imported fossil fuels in recent years. In addition, possible alternative sources of supply are discussed and commodity-specific aspects and challenges regarding the substitutability of import volumes are highlighted.

Around three-quarters of natural gas imports to the EU in 2019 were sourced via pipelines. Liquefied natural gas (LNG) accounted for about 23 percent of total natural gas imports. Potential substitution of supply volumes with pipeline-bound gas or with LNG imports is limited in each case by infrastructure: scarce pipeline, regasification, and liquefaction capacity. In addition, the EU competes with large Asian importers for LNG procurement. A large portion of global LNG supplies are handled through long-term contracts which limits the possibility of short-term deliveries to Europe.

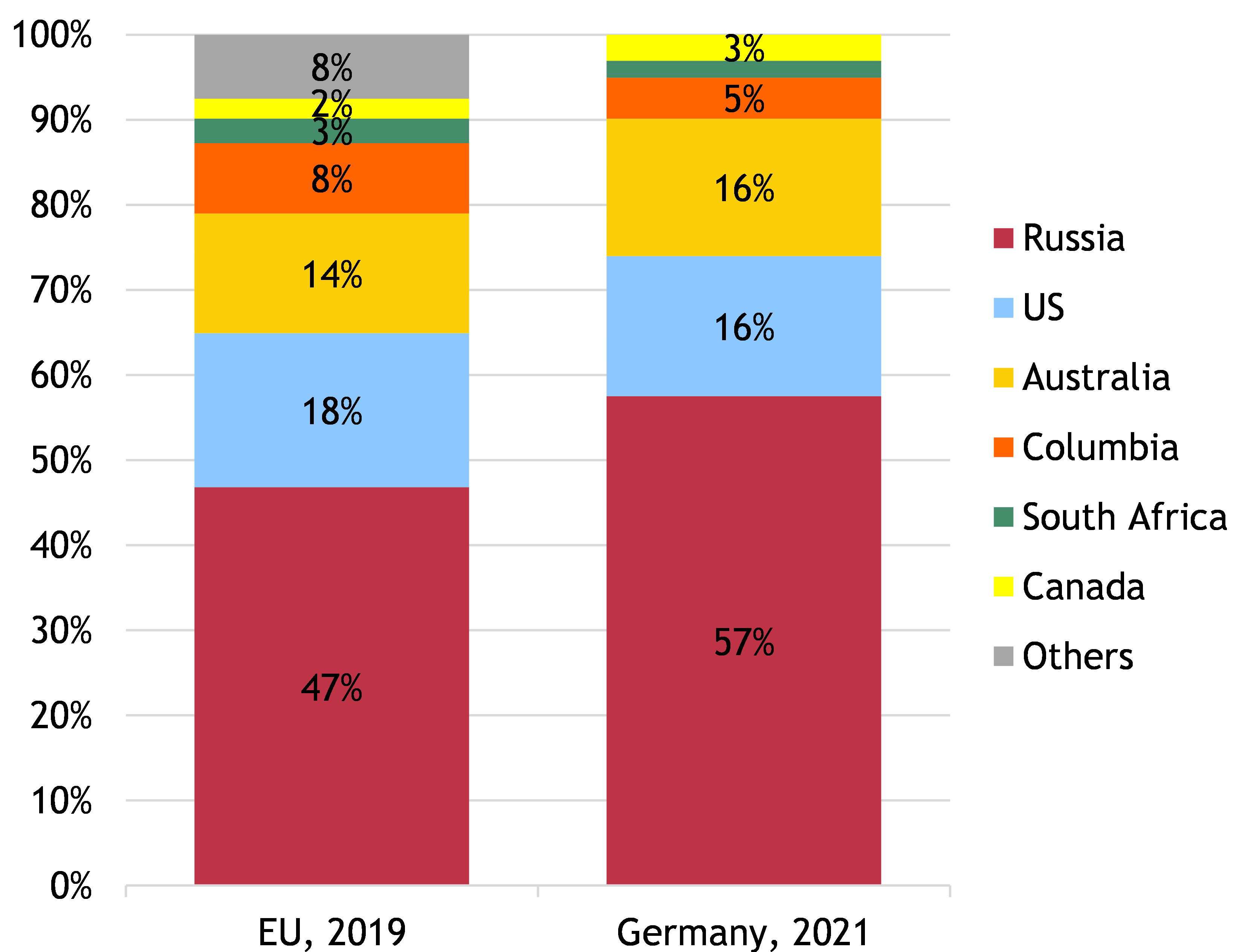

In 2019, the largest shares of hard coal imports to the EU came from Russia (47 percent), the USA (18 percent) and Australia (14 percent). For substitution of supply volumes to the EU, producers in the Atlantic Basin are the first candidates due to the shorter supply routes: the USA, Colombia and Canada. Additional imports from South Africa and Australia are conceivable; however, due to its geographical location, the EU faces stronger competition from importers in Asia for hard coal supplies from these countries.

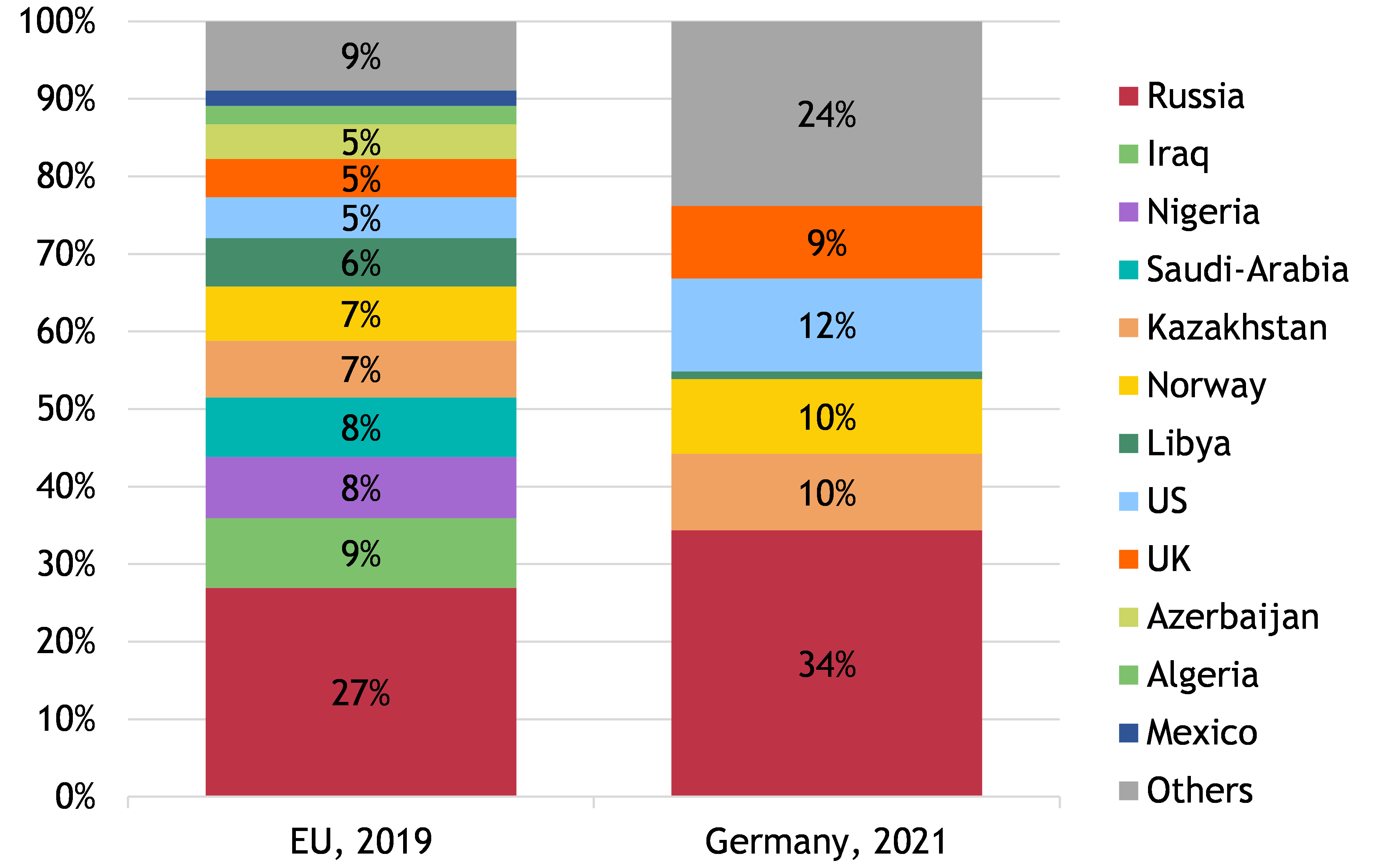

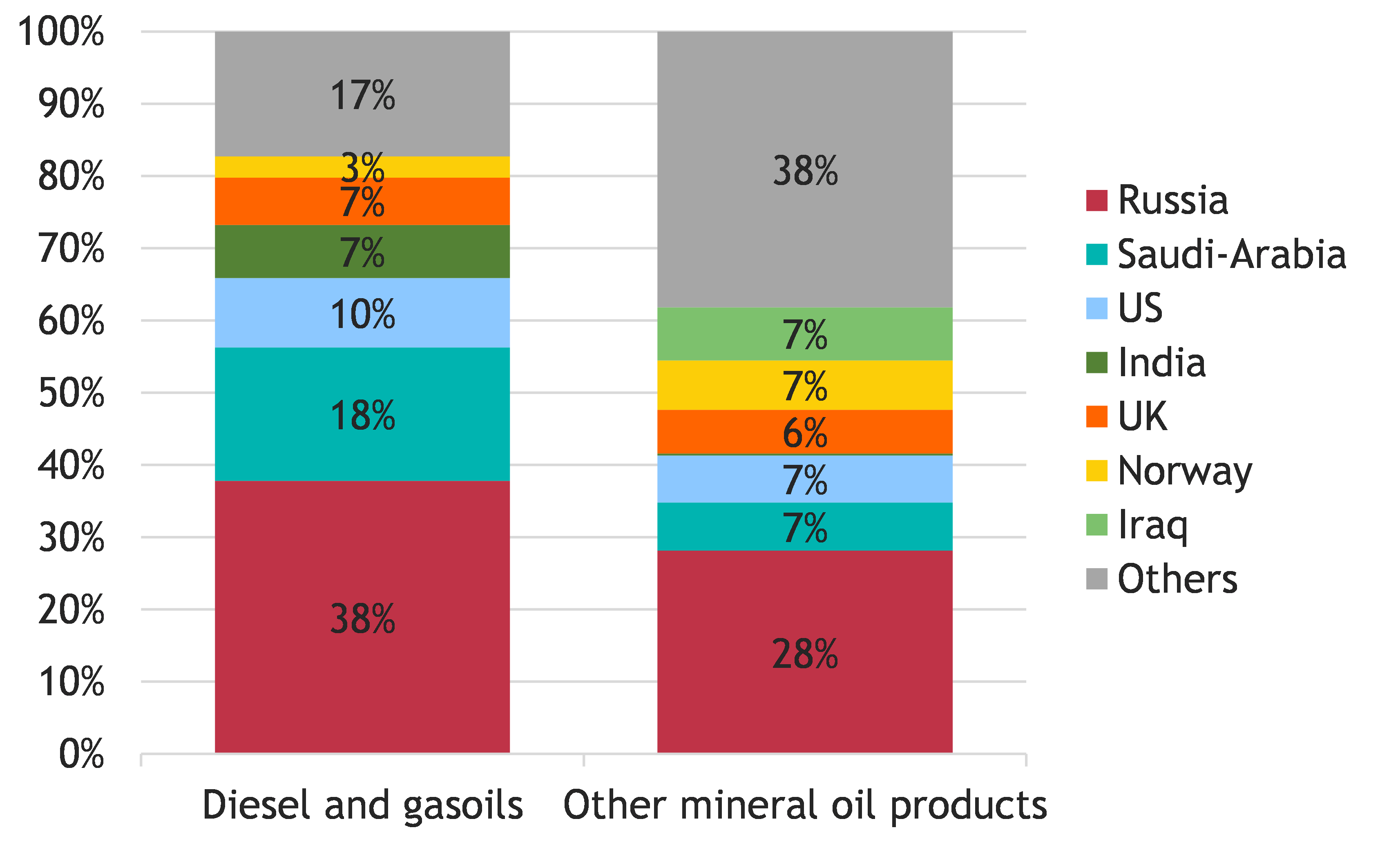

In 2019, the EU imported crude oil from a large number of countries, such as the MENA states (28 percent in total), Russia (27 percent) and Nigeria (8 percent). Possible sources of supply substitution would be the U.S. and the OPEC countries. The latter have spare production capacity that could be ramped up in the short term (for example, Saudi Arabia, according to the EIA). However, in February 2022, the OPEC+ countries (OPEC plus Russia) agreed on a moderate increase in their production volumes in March 2022. In addition to crude oil, the EU imports diesel and other petroleum products. Important suppliers of these products are currently Russia, Saudi Arabia and the USA.

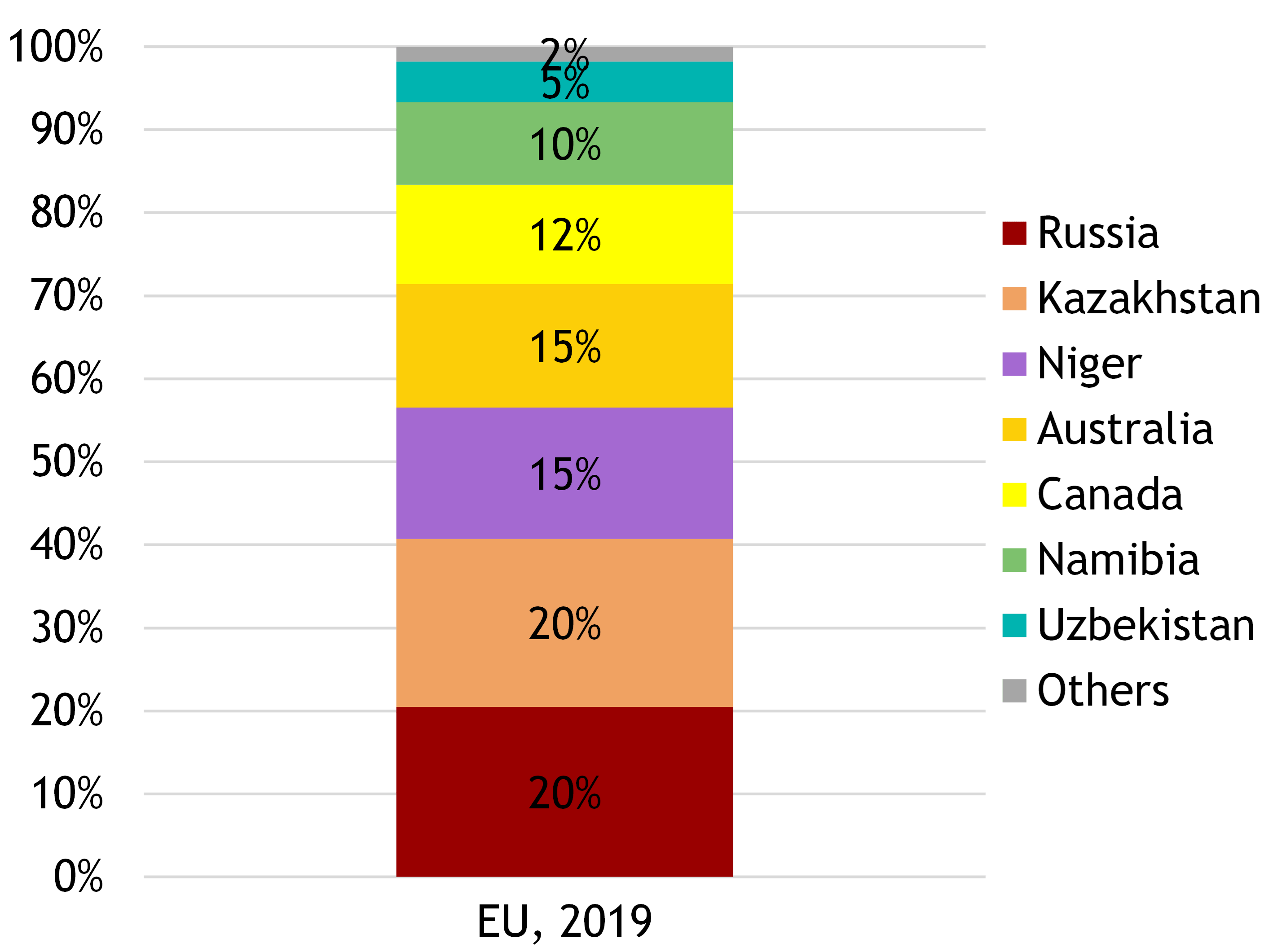

The largest exporters of uranium to the EU are Russia and Kazakhstan (20 percent each in 2019), followed by Niger and Australia (15 percent each in 2019). In order to use uranium for energy production, it must first be enriched; fuel assemblies are then produced. The top exporters of fuel assemblies in 2019 were Russia (38 percent), Sweden (24 percent), and Germany (12 percent). Uranium as well as fuel assemblies are primarily traded through long-term supply contracts. This, along with long lead times for enrichment and fuel fabrication, is likely to make short-term supply substitution difficult.