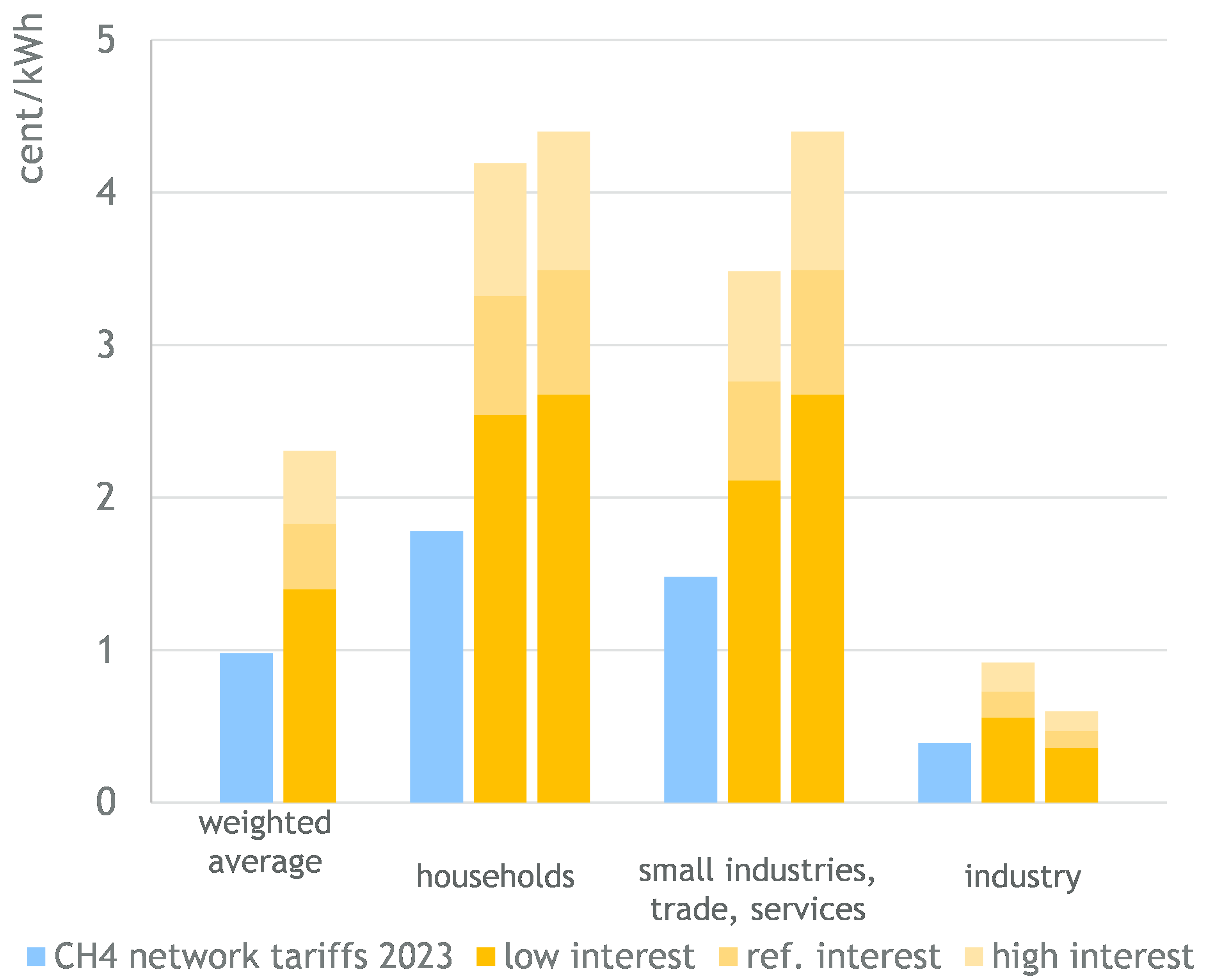

The network tariffs for hydrogen could average around 1.8 cents/kWh (inflation-adjusted) in 2045 in a scenario regarding hydrogen demand and hydrogen grid expansion defined by the Deutscher Verein des Gas- und Wasserfaches e.V. (DVGW), according to estimates by the EWI on behalf of the DVGW. Compared to the current network tariffs for natural gas, this would imply an increase of approx. 87% or 0.8 cents/kWh. Depending on how the costs are allocated to the different customer groups, the charges for these groups would vary accordingly. In the analysis, therefore, two different estimates were considered for the distribution of costs (“Proportional shares 2023” (PA) and “Distribution by network level” (WnN)).

In the analysis “Estimation of future hydrogen network tariffs—analysis based on a hydrogen scenario of the DVGW,” a team from the Institute of Energy Economics at the University of Cologne (EWI) investigated the level of potential hydrogen network tariffs depending on different interest rates on behalf of the DVGW. “In addition to the level of interest rates, the key factors influencing the estimation of network tariffs are the investment requirements and operating costs of grid operation, as well as the assumed demand for hydrogen,” says Dr. Fabian Arnold, Project Lead at EWI.

The costs for the assumed rededication of the distribution network were calculated by DBI – Gastechnologisches Institut gGmbH (DBI) on behalf of DVGW. The assumed demand for hydrogen comes from the DVGW and would amount to 398 TWh in 2045. This corresponds to around half of today’s natural gas consumption. The investment cost in this scenario could amount to 70 bn € (inflation-adjusted). Interest and operational expenditure would come in addition.

The level of hydrogen demand, to which the costs of grid management are allocated, is a key assumption when estimating future hydrogen network tariffs. If it is initially assumed that the grid would be expanded to the same extent as assumed in the DVGW scenario, regardless of demand, a lower demand would increase the hydrogen network tariffs for all customer groups, and a higher demand would reduce the hydrogen network tariffs, all other things being equal.

If demand in the building sector were lower than in the DVGW scenario, investments in the hydrogen transmission and distribution grid would also be allocated to lower demand. Consequently, the hydrogen network tariffs of the remaining customers connected to the distribution grid would increase particularly sharply, assuming the same level of rededication of the distribution grid. However, it is also conceivable that the distribution grid – unlike the transmission grid – would be rededicated to a lesser extent in the event of lower demand. This could limit the increase in hydrogen network tariffs for customers.

Due to the long lead time and central planning in the hydrogen transmission grid, it can be assumed that new construction and reallocations will largely be carried out regardless of the demand that is realized. Lower demand in distribution grids would result in the transmission grid cost being distributed to fewer consumers, i.e., industrial demand. In the event of lower industrial demand than in the DVGW scenario, the remaining customer groups would have to bear a higher share of the costs of the hydrogen transmission grid.

Looking ahead to 2045, there is great uncertainty about the future costs and possibilities of hydrogen procurement. It is unclear what quantities of hydrogen could be produced domestically at what prices and what quantities could be imported at what prices. Were hydrogen procurement costs amount to 5 to 10 ct/kWh (inflation-adjusted plus structuring cost; c.f. EWI PtX-Cost-Tool), these would dominate the final consumption price. “The focus of the analysis is on the estimation of hydrogen network tariffs in the DVGW scenario. However, based on current estimates for hydrogen procurement costs in 2045, it can be said that the price for hydrogen that consumers would pay is likely to be significantly dominated by the development of procurement costs,” says Arnold.