Investments in hydrogen networks are currently associated with higher risks than in existing network infrastructures. In order to enable a prompt market ramp-up, the regulatory framework for the hydrogen core network is currently being defined. “This is intended to ensure that the costs and risks of hydrogen grid investments are shared fairly and sustainably between grid operators and the state,” says Dr. Philip Schnaars, Head of Research Area Regulation at the EWI, who has written the analysis alongside Tobias Sprenger and Martin Lange. “Overall, it remains to be seen whether the current regulatory framework is sufficient to incentivize sufficient investment in the hydrogen core network.”

Against the backdrop of the current plans for the hydrogen core network, a team from the Institute of Energy Economics (EWI) at the University of Cologne discusses the investment environment for hydrogen network investments in the analysis “Green Transformation needs Investment: Challenges of Hydrogen Networks”, which was commissioned by Open Grid Europe GmbH (OGE).

According to the gas transmission operators’ draft, around EUR 2 billion will have to be invested annually over the next ten years to build the hydrogen core network, which is more than double the historical investment level of the transmission system operators. According to a current draft bill this investment volume is planned to be funded by private investors. Whether private investors devote their capital to the H2 core network depends on the extent to which these investments are advantageous compared to other investment opportunities – such as investments in the electricity grid. From an investor’s point of view, the regulatory defined return on capital and the expected risk profile are essential parameters to the individual investment decision.

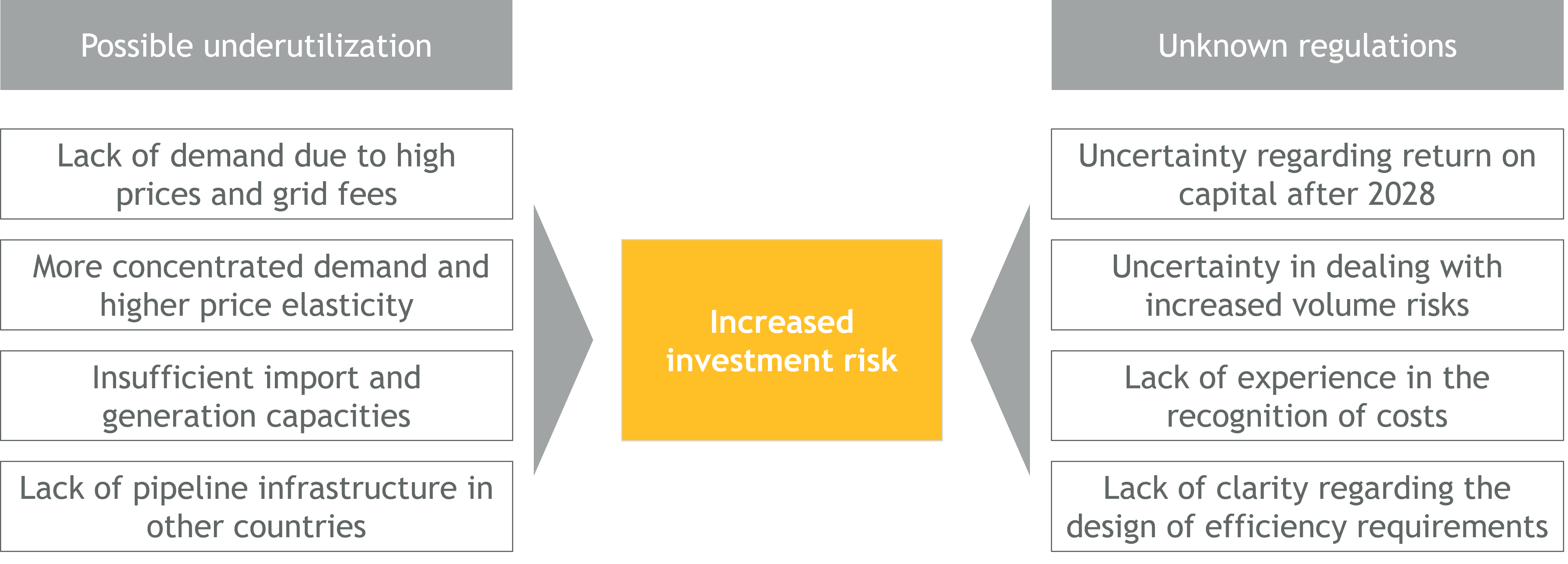

It can be assumed that investments in hydrogen networks are subject to higher risks compared to existing infrastructures (see Figure 1). In particular this is attributable to

– Risk due to underutilization: Lack of demand due to high prices and grid fees, more concentrated demand and higher price elasticity, insufficient import and generation capacity, lack of pipeline infrastructure in other countries

– Risk due to unknown regulatory requirements: Vagueness of the return on capital after 2028, uncertainty about how increased volume risks will be addressed, lack of experience concerning future revenue cap calculation, lack of clarity regarding the design of possible efficiency requirements

“All these factors mean that investments in hydrogen networks tend to be subject to higher risks,” says Tobias Sprenger, Head of Research Area Hydrogen at the EWI. “It is currently unclear whether the necessary investments will be made in view of these risks.”

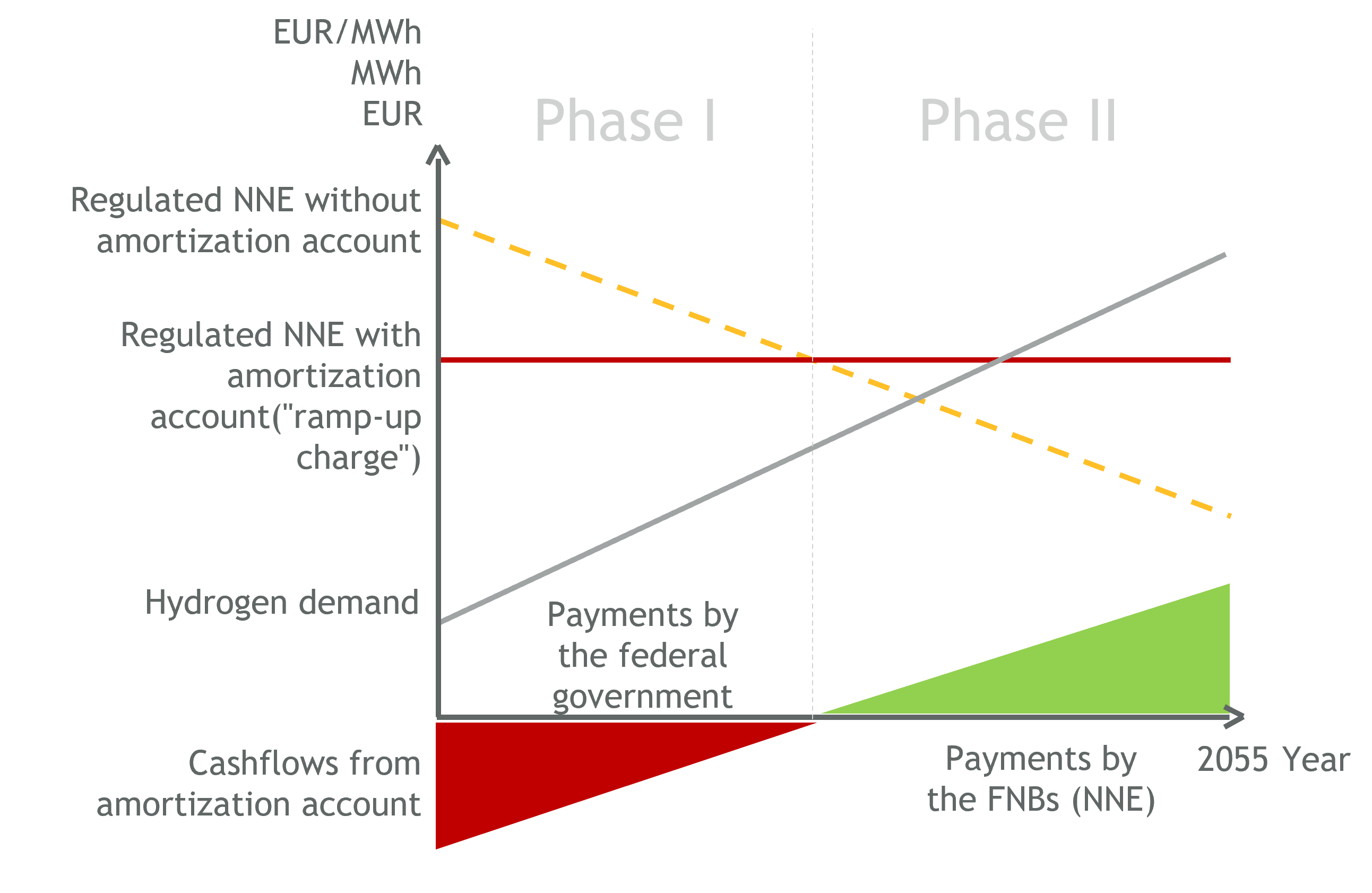

The current draft bill proposes the introduction of an amortization account through which the federal government aims to reduce risks for grid operators. A key element is the reduction of grid fees at the beginning of the market ramp-up. Subsidies are intended to prevent excessively high grid fees, which would make the use of hydrogen uneconomical. The resulting shortfall is to be repaid by the grid operators through subsequent grid fee surpluses. This amortization account shifts the investment risks partly to the state, which can have an investment-promoting effect on potential investors. Nevertheless, risks remain for grid operators, for example through a planned deductible of the account deficit.